Recently, a friend and owner of an IT company (Michelle Herring of CMIT Solutions of St. Charles and Chesterfield), passed along a question she encountered. What do people do about their online accounts when estate planning?

First, I just have to say, I loved that she mentioned this. In a world where more and more of our world is online, it’s a real problem. Even for older families this presents a real issue. Mom now does all of her banking online and doesn’t receive paper billing. How do the kids know what bills are due and what’s already been paid? For those of younger generations constantly on Facebook or even LinkedIn, what happens to those accounts?

Unfortunately, this is the new frontier of estate planning, meaning the laws haven’t caught up with reality. Many (if not all) of the online accounts you use require you to accept a user agreement stating you will be the only person using the account. This means you’re technically violating your agreement with that company if you give another person your password.

Even more of an issue, many online entities have no set policy (and certainly not consistent across companies) of what happens after a user passes: Is a court order required? Can a trust access the account? Does a power of attorney give access?

Few websites truly plan for their user’s eventual (and guaranteed) non-use. There has been discussion that some online entities will or have settings that allow you to give another person access to your account if you don’t log in within a specific amount of time or other forms of estate planning within your online account. After some searching, I could not find these settings in a few of the bigger sites (feel free to share if you do).

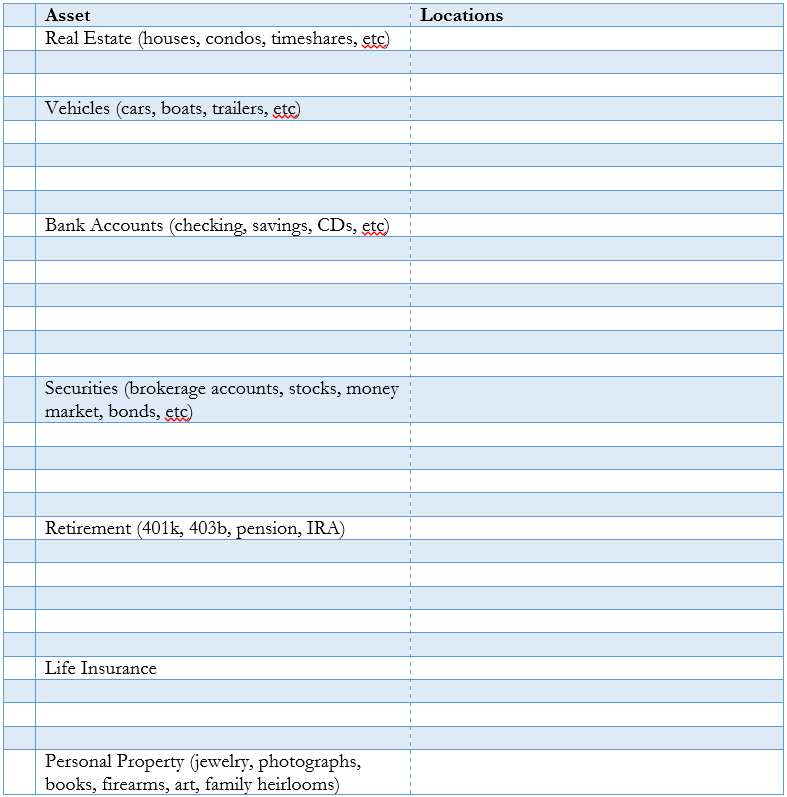

So what do you do? There are a few options. Some practical and some not. First and probably the most “legal” (but also probably the least practical) is to keep a list of all your online accounts, so your estate can contact the company and follow the given procedures of that company (if there are any). But really, who has time to create a list and then the hassle of your estate trying to contact and comply with several (plus some) different companies.

Another option is to create a list of all of your accounts and passwords. Either written somewhere or in a document. Hopefully, you can figured out why I don’t recommend this. While it gives your estate access to your accounts, it may inadvertently give access to others as well.

The best solution I’ve seen so far (also recommended to me by CMIT Solutions… seriously, check them out) is to use a password storing cite such as LastPass or KeePass. These applications are secure mobile databases that allow you to store your passwords online on an encrypted site. Essentially, you only have to remember (or share) one password and you have a list of all your online accounts with the passwords. An added feature of LastPass (I installed it over the weekend) is that you don’t have to manually enter the list. As you visit the websites, LastPass will give you the option to save the site and the password.

All of these options have their downfall, but no matter how you plan for your online world, it’s important to consider and plan for as well.

What is probate?

What is probate?